Official documentation: Agencia Tributaria Modelo 720.

Description

Form 720 is an informative return in which a tax resident reports his or her assets outside Spain, as follows

- bank accounts

- investments

- real estates.

It must be filed by those who are tax residents of Spain and at the time of the fiscal year on December 31 and had in one of the above categories of property more than 50.000 €.

The submission period is January 1 through March 31.

The value of assets is calculated as of December 31 of the reporting year.

The form can be submitted in the following formats:

- ready-made file (more details)

- filled out manually (more details).

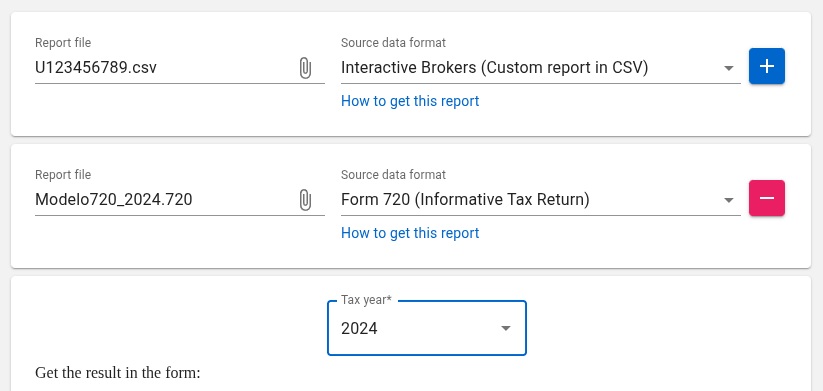

The service provides a mechanism for generating a ready-made Form 720 based on broker reports. The format of the source reports for uploading is exactly the same as for generating Form 100. However, there are several aspects that need to be taken into account.

Providing info on assets that are not securities

In order for data on property that is not securities to be included in the resulting Form file, it is necessary to add Form 720 for the previous or current year, which will contain this data, to the list of reports uploaded for processing. For example, you can fill them in manually, save them to a file, and add the resulting file together with the broker’s report. In this case, data on non-securities assets from Form 720 will be combined with data on securities taken from broker reports.

Declaration of securities that do not appear in processed brokerage reports

If you need securities that do not appear in the downloaded brokerage reports to be included in the generated Form 720, you must record them in a universal format, specifying their quantity and value on the sheet Securities positions at the end.

Detailed form showing changes compared to the previous year

If the “Detailed form” is selected, two values will be displayed for each security: the number of securities from the previous year (taken from the previous Form 720) with the value in the “Origin of good or right” field “M” and the number of securities purchased “A” or sold “C”. Please note that if you want to correctly submit Form 720 with the “Detailed form” option enabled, you must upload the previous Form 720 along with the broker’s report(s) for the current reporting year (more details).

If the “Detailed Form” option is not active, the current number of securities will be displayed, along with the value in the “Origin of good or right” field “M”.